What is the role of each type of Contract in Project Management?

We know that every day, many projects and infrastructure works are undertaken across the world. These projects can be of any type ranging from software, construction, telecom, to scientific, and oil & gas. Every project has stakeholders/clients and vendor/seller/supplier in common. In other words, every project is initiated by an organization which should be supported by suppliers for the various needs of the procurement. In project procurement management, these two parties are generally termed as 'buyer' and the 'seller.' The agreement between the two is called the “contract.”

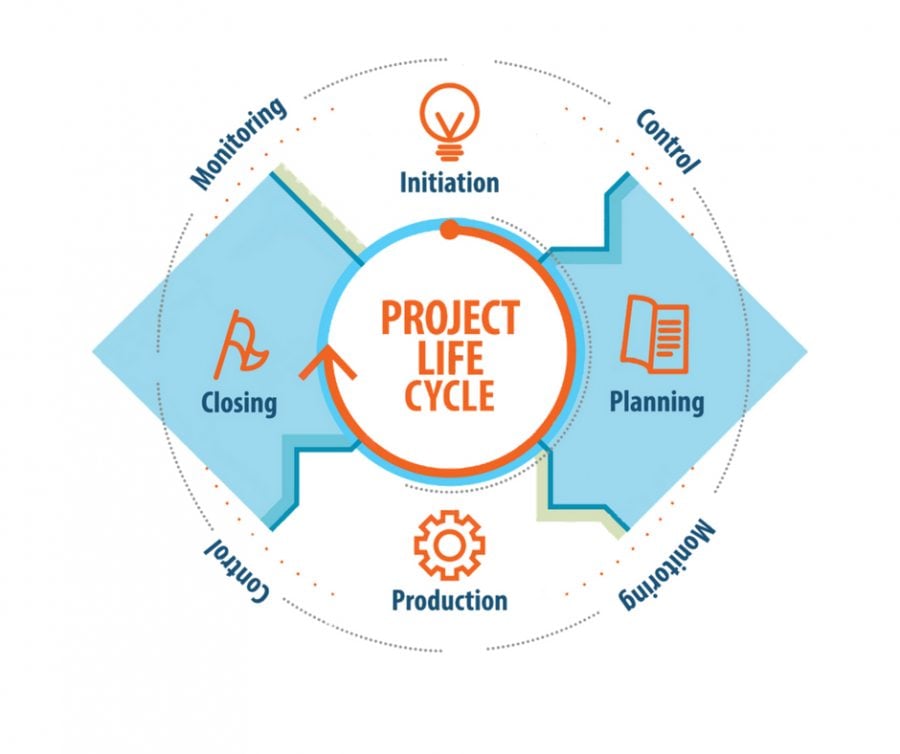

Source: https://twproject.com/blog/project-life-cycle-phases-and-characteristics/

Contracts are an essential part of procurement management. Since formal, it creates a legal binding between the buyer and the seller. Contracts are necessary for project management as they provide relief on either side. It is by managing the risks involved in procurements. A contract is required to share and bear the individual’s responsibilities in completion of the project. This is more so in larger and complex projects. Good procurement practices help the corporates to increase their profitability.

In this article, an attempt is made to throw more light on procurement as well as on contract management. It is to get the professionals to understand and be conversant with the contractual processes and their types.

The Project Manager:

As per PMBOK 6th edition section 3.2 (page 91), Project Manager is the person who leads the team that is responsible for achieving the project objectives. The performing organization assigns a Project Manager.

Based on the authority level, the project manager performs numerous roles. Many organizations based on the project size and complexity, assign 'a contract project manager.' A contract project manager's role is significantly different from the Project Manager.

Contract Manager:

The Contract Project Manager (also referred to as Contract Manager) plays a very critical role for an organization. He/she manages contracts throughout the projects and their life cycle. On many occasions, they also play the role of a Liaoning person between the companies, employees, vendors, customers. He/she creates the contract’s repository and is solely responsible for maintaining all the contractual records. The company uses these records for their projects, which finally become part of Record Management.

Some of the key responsibilities include but not limited to:

- Draft, develop, negotiate and execute the contract.

- Create policies and procedures to the contract and ensure the effectiveness.

- A Liaoning person and a contract facilitator.

- Manage and close the contracts throughout the project duration.

- Create a contract repository and update periodically.

Contract Management:

‘Contract’ as the term specifies is an agreement between two parties in general. In project management, it’s a formal agreement between a buyer and a seller (more often referred to as supplier). The agreement is made to procure goods and services required for the agreed project. This document needs to be prepared by the Project Manager (or the contract project manager if assigned). It is in coordination with Procurement Manager during the project planning stage. It has to be documented as a Procurement Management plan, which is a part of the primary Project Management Plan.

Contract Management, a part of the Project management, deals with the vendor/seller/supplier (as termed in the contract). It also manages the procurements according to the terms and conditions set in the ‘Contract.’ The terms and conditions are agreed mutually between the buyer and seller.

Contract management is the art and science of managing a contractual agreement throughout the contracting process.

Though many times the contracts are simple and straight, they are more complex. It happens to be in larger projects as many procurements and suppliers are involved.

The procurement contract being a formal document must be carefully designed/planned. It should also be mutually agreed to avoid the complications between the buyer and the seller. It is all to execute the project smoothly for the timely completion.

Source: Freepik.com

Following are the guidelines to be considered while deciding on procurement contract:

- Complexity of procurement

- Location of procurement

- Availability of suppliers/contractors

- Local governing regulations

The above guidelines assist in deciding the type of contract suitable for the project undertaken. The following are the types of contracts generally followed in Project Management.

Types of contract:

Most of the contractual relationships are broadly categorized as either:

- Fixed-Price contract

- Cost reimbursable

- Time & Materials Contract

The third type of contract is seldom used.

As mentioned earlier, project type decides the contract type. So, in many projects based on the procurement requirements, one or two contract types are chosen. To facilitate the project requirements, they are combined into a single procurement.

1. Fixed Price Contracts:

In this category, the contract involves a fixed price for a defined product or service or the result to be supplied/provided. These types of contracts are recommended when the scope of service is completely defined and final.

Here are the different types of Fixed Price contracts used in managing projects:

- Firm Fixed Price (FFP):

The prices of the goods and services are set and are never subjected to change unless the scope is changed and agreed mutually. This type is favorable mostly to the buying organizations. Because the extent of buying the goods remains unchanged and recurring buying happens.

- Fixed Price Incentive Fee (FPIF):

The price ceiling is set, and the seller needs to perform and fulfill the contract requirements within that price. All the costs above the price ceiling are the responsibility of the seller. This type gives both the buyer and the seller some flexibility for performance with technical incentives. The incentives are tied to achieving agreed upon metrics such as cost, schedule and technical expertise of the seller.

- Fixed Price with Economic Price Adjustments (FPEPA):

It is suitable when the contracts are executed in different countries and payments are made in a different currency. Also, if the seller’s work lasts for a few years (3-5 years generally) this contract is fitting. This contract gives an option to make adjustments in the predefined final payment as agreed to in the contract. It can be due to changed conditions such as inflating rates (may increase or decrease) on specific commodities.

2. Cost reimbursable contracts:

This type of contract involves cost reimbursement (payments to the work done) for the costs incurred during completion of the contractual job. It is along with a pre-defined fee representing seller profit. It is recommended if the scope of the work is expected to change during the contract period.

Source: Freepik.com

This type of contract includes:

- Cost Plus Fixed Fee (CPFF):

The seller gets all the allowable costs agreed in the contract. The seller also receives a fixed fee payment, which is calculated as a percentage of initial estimated project costs. Unless the project scope changes, this fee remains unchanged.

- Cost Plus Incentive Fee (CPIF):

The seller gets the reimbursements for all the costs incurred on performing the work agreed in the contract. Based on the final costs incurred (greater or lesser than the initial planned cost), both the buyer and the seller share their expenses. The sharing is based upon a pre-negotiated cost-sharing formula. Generally, it is an 80/20 split over the target costs based on the actual performance of the seller.

- Cost Plus Award Fee (CPAF):

In this type, the seller gets his/her legitimate reimbursements. But a majority of the fee is received upon meeting some technical/subjective performance that is pre-set in the contract. This solely depends on the buyer’s determination and the seller’s performance.

3. Time & Material Contracts (T&M):

This a hybrid type of contract combining the features of Fixed as well as Cost Reimbursable contracts. This is often used when contractual requirements (scope) is not known/ prescribed. Also, this type of contract is suitable for acquisition/hiring of experts, project staff required for a particular period.

Conclusion:

By this, you might have understood the concept of project procurement management, processes involved in the procurement exercise, methods, and all about the contract management.

It is understood that the contracts help both the performing organization (buyer) and the service provider (seller) in mitigating the risks in all sorts of procurements. It also supports both in attaining profitability by choosing the appropriate type of contract. Contracts exist between an employer and employee if required to hire on a temporary basis.

The project manager or the contract manager or many times procurement manager plays the significant role in negotiating and bringing the competitive and cost-effective vendors/suppliers/sellers on board using their skills and picking the right methodology in meeting the project objectives.

Finally, contracts make both the buyer and the seller abide by the law.

Click here to kickstart your Project Management Career